MSME in India: Govt Benefits, Process and Documents Required

March 21, 2017 by Tanya Sharma

MSME (Micro, Small and Medium Enterprises) are entities dealing in manufacturing or service sector defined on the basis of their size and investment. The Govt. Of India provides various subsidies, tax benefits and loans to the MSME holders to promote their development.

What is MSME Registration?

Micro, Small and Medium Enterprises (MSME) Registration provides benefit to the individual/companies who fall under the investment limit decided by the Government. The registration is meant for the entities dealing in the manufacturing or service sector.

Any business entity (sole proprietorship, partnership, OPC etc.) can apply for the msme certificate, however; there are different investment limits for the applicants. It is also known as Udyog Aadhar Registration and can be done in both online and offline mode.

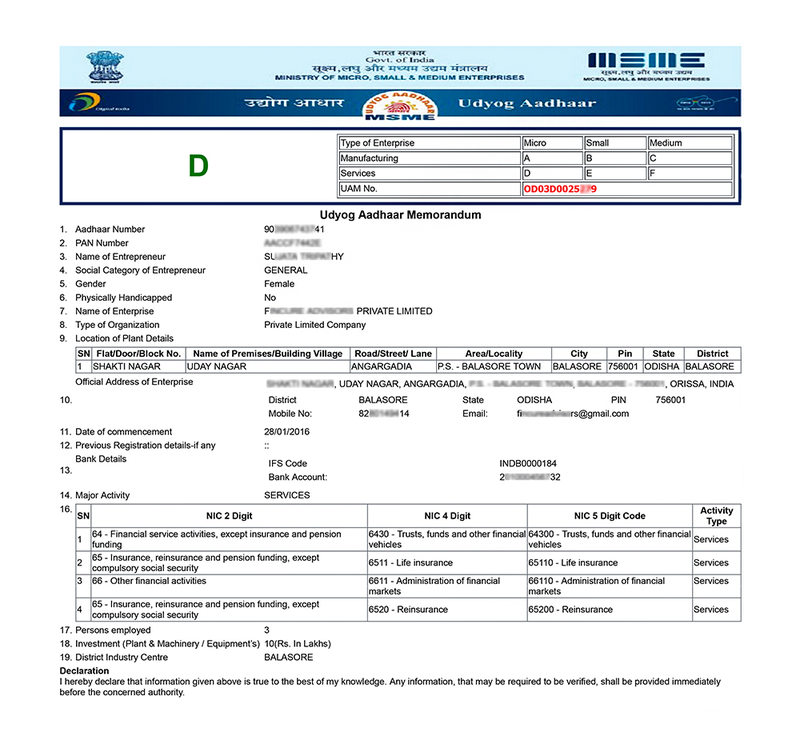

MSME Certificate Sample

The Govt. of India has categorized the enterprises eligible for registration under production/manufacturing and service sector.

Following businesses are eligible for MSME Registration in India.

| Sector | Micro | Small | Medium |

| Manufacturing | Rs. 25 Lakh | Rs. 5 Crore | Rs. 10 Crore |

| Service | Rs. 10 Lakh | Rs. 2 Crore | Rs. 5 Crore |

It is not necessary to register your business under the MSMED Act however; you can avail several Government benefits only when you have the registration certificate. You can apply for the certificate on the Government website (Udyog Aadhar).

What are the Documents Required for MSME?

All the documents and forms are filed online only. The applicant needs to submit scanned copies of the following documents –

Address

Proof

Business

Proof

Sale / Purchase

Bills

Identity

Proof

- Aadhar and PAN Card.

- Address Proof (Business)

- Registration Proof (Business)

- Sale and Purchase Bills

- Licenses (Industrial license)

The applicant can apply for Udyog Aadhar (MSME) Registration even if he does not possess an Aadhar Card only if; he has applied for it with the concerned authorities.

In such a case, the application is filed by the MSME- Development Institute on behalf of the enterprises who do not have an Aadhar Card at present. The department would require the following documents –

- Aadhar Enrolment ID Slip

- Request Copy of Aadhar Application

- Identity Proof

The Identity Proof may include any one of Bank Passbook, Voter ID Card, Passport, Driving License or PAN Card.

Registration Cost for MSME

There is no Govt. Fee for MSME registration, however; if an attorney or agent is applying for MSME on your part then you would require paying a professional fee.

If you want you can also file the application for free without any professional help however; it is always better to consult a lawyer in case you are confused on any of the step.

Quick Company, a legal registration company have minimal charges for MSME Registration.

| Government Fee | Rs 0 |

| Professional Fees | Rs 2,033 |

| Goods & Service Tax | Rs 366 |

| Total Cost | Rs 2,399 |

Professional Fee involves preparing necessary documents and filing the form. During this process, the applicant will be guided on the necessary information by our MSME experts.

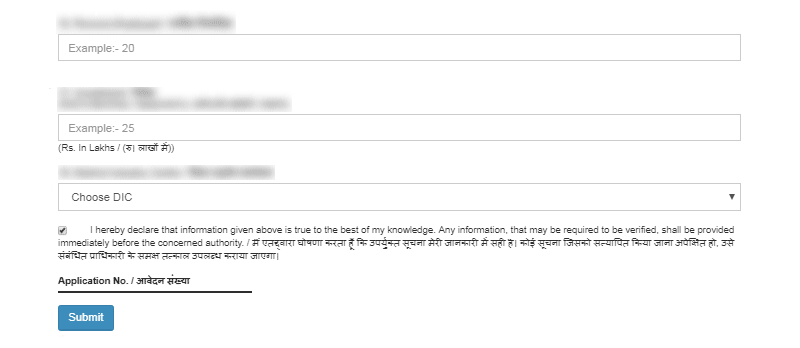

MSME Registration Process [Step by Step]

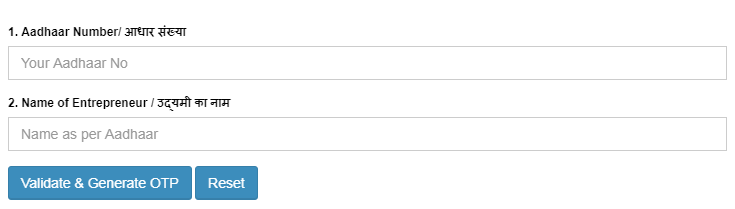

The Udyog Aadhar (MSME) Registration process is extremely simple and straight forward as the applicant can file it for free on the Udyog Aadhar online portal. Follow these steps to apply for MSME in India for free.

- To initiate the registration process you would require your Aadhar Number.

- Once you validate the process, fill the online form with all the details and attach supporting documents wherever required.

- On submission of the form successfully, you will get a unique number on your registered e-mail/mobile number to check the status of your application.

- The Udyog Aadhar department will examine your application and on satisfaction will issue a registration certificate.

Provisional Registration can be taken for initial 5 years if the applicant has not set up a business yet however; you would require applying for a permanent license as soon as the business is set.

You will have to re-apply for the MSME Registration if, you are unable to commence business within the period of provisional registration (5 years).

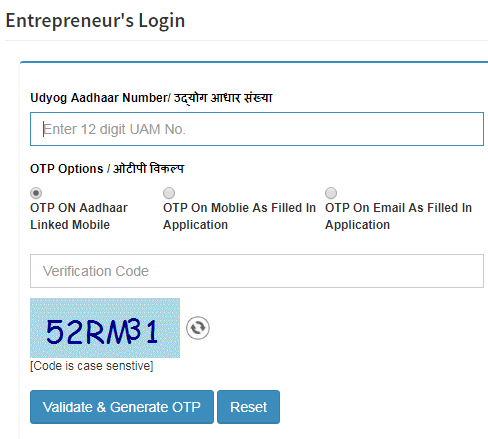

How to Update your MSME?

You can also update or change your details after Udyog Aadhar Registration (MSME) either through online or offline mode. The applicant needs to visit the nearest Udyog Aadhar Centre if filing through offline mode.

You need to provide relevant proof in case you wish to update your address or any business related information. You will be given an affirmation number to track the status of your application.

On verification, an updated Udyog Aadhar Number will be send to the applicant’s registered address via post. You can also update the information on the Udyog Aadhar Portal under the Update Udyog Aadhar tab and complete the steps that follow.

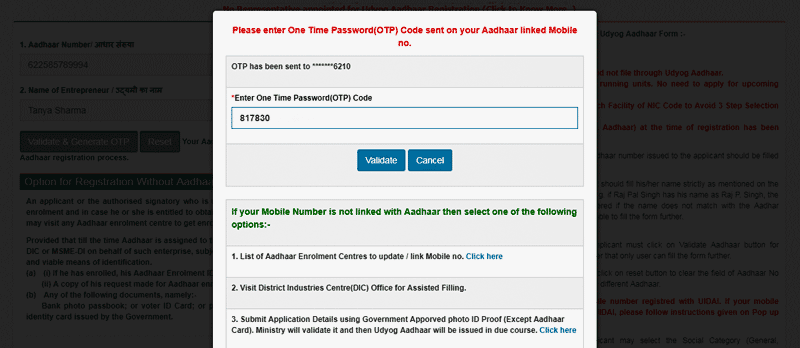

You will receive an OTP once you initiate the process on the medium of your choice.

- OTP on Aadhar linked Mobile

- OTP on Mobile as filed in application

- OTP on e-mail as filed in application.

Select any of the below mentioned option to receive an OTP and complete the process.

Benefits of MSME in India

Udyog Aadhar (MSME) Certificate promotes the development of small and medium enterprises and the entities can avail different tax benefits, bank schemes, excise exemption, reservation in delayed payment act under the MSMED Act.

The Govt. of India, too, has initiated different schemes under Central and State Government to provide a stable background to such companies. A few of them are –

- Credit Guarantee Scheme

- Micro and Small Enterprises Cluster Development Programme

- ISO 9000/ISO 14001 Certification Reimbursement Scheme

- MSME Market Development Assistance

- Micro Finance Programme

MSME Loans

The Small Industries Development Bank of India has introduced a number of loans in India to provide credit facilities to small businesses. Some of the popular loans available to MSME’s are –

Pradhan Mantri Mudra Yojana

The Government provides collateral free loans to small businesses of up to Rs. 10 Lakh. It allows banks to finance loans to people according to three categories.

- Shishu loans for up to Rs. 50,000

- Kishore loans for Rs. 50,000 to Rs. 5 Lakh

- Tarun loans for Rs. 5 Lakh to Rs. 10 Lakh

Business Loan in 59 Minutes

The Prime Minister of India has automated the entire loan approval process to provide loan in less than 60 minutes. The loan amount gets credited in the applicant’s bank account within 8 working days. The Government has also launched a new portal to speed up the entire process.

4E (End to End Energy Efficiency)

It was launched jointly by the India SME Technology Services Ltd. and World Bank aiming to execute energy efficiency across India meets the costs of capital expenditure and purchase of plant/machineries.

Intellectual Property and MSME

The Government of India in order to promote the registrations of Intellectual Property has offered rebate on the prices of Patent and Trademark Registration if the applicant already possesses an Udyog Aadhar (MSME) Certificate.

More on : IP Related Sanctions for MSME and Startups

All registered MSME’s will be provided one-time support of up to Rs. 25,000 for National Patent Application and Rs. 2 Lakh for International Patent Application. The Government will also offer one-time grant of Rs. 45 Lakh for setting up Intellectual Property Facilitation Centres and Rs. 18 Lakh as recurring expenses for 3 years.

The MSME holders also get almost 80% rebate on the Government Fee of patent filing while 50% rebate on trademark filling fee (government charges) for Start-Ups under the Trademark Rules 2017. However; in this case the annual turnover of the companies must not exceed Rs. 25 Crore.

GST for MSME Sector

The Goods and Service Tax is a unified tax system applied on all goods and services in India. It has now replaced many indirect taxes like service tax, value added tax etc. The Government of India focuses to strengthen the MSME sector since it greatly contributes to the economy and growth.

As a promotional measure, The Government has exempted GST Registration for the Micro, Small and Medium Enterprises if the annual turnover does not exceed the limit of Rs. 20 Lakh.

Also, the companies whose annual turnover is up to Rs. 2 Crore are exempted from the compulsory audit of the company accounts. However; the person can file a quarterly return if he wishes.

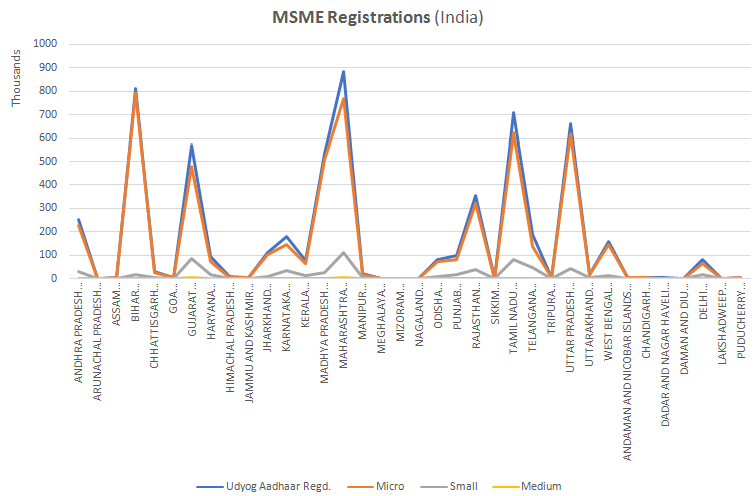

MSME Impact & Analysis

Introduction of MSME in India has largely contributed to generate more income and employment opportunities. It has also enhanced entrepreneurship especially in states like Assam, Nagaland, and Mizoram.

The MSMED Act 2006 provided several benefits to the small entities which opened gates for technological benefits, improved sales, import/export and business registrations. It also introduced unified policies for marketing, infrastructure and credit.

The Government of India has also initiated various subsidy schemes and loans to provide financial support to the Micro, Small and Medium Enterprises. Various banks like the Oriental Bank of Commerce have also reduced the interest rates on the MSME Loans in order to support small scale entrepreneurs.

The Finance Ministry of India is striving to ease the banking process, make it customer-friendly and provide fast processing of loans with less paper-work.