What is the Meaning of Company Analysis?

October 05, 2018 by Akshara Bala

Company analysis is a process/study that gives the status-quo of the company’s performance. It presents the ‘on paper’ value of the company from a productivity and financial point of view, giving a comprehensive picture of where the company stands in the market and amongst its competitors.

The company analysis answers vital questions regarding the company’s risks, liquidity, asset value, profit growth, and cash flows. Since it gives the overall picture of the company, it is referred to as fundamental analysis.

Meaning and Purpose

The company analysis helps ascertain various aspects of a company’s health. Usually presented in a written format, the analysis focuses on:

- Feasibility

- Productivity

- Corporate financial health

These three factors built into the company’s strengths, weaknesses, and immediate threats. Thereby, it helps the company take the necessary steps to handle any unfavourable situations and use positive outcomes to their maximum benefit.

What is the Analysis Used for?

The company analysis can be for internal consumption, as well as for the benefit of stakeholders.

- Potential investors and financial institutions use a company’s analysis to gauge the performance and the associated merits while funding the company’s activities.

- It is also a key tool when a company plans to expand into farther horizons. It helps the company judge the impact of a new portfolio and the impact of the diversified investment.

- A complete picture of the current scenario helps give a better understanding of future projections. For instance, based on the current growth rate of the company’s profit, the company can gauge if the introduction of a new product would be feasible.

- It helps the Board of Directors analyse corporate efficiencies and also isolate wasteful exercises. For instance, a company with several products can see which of its products are doing better in comparison to the amount manufactured. And accordingly, take steps to boost that product further.

- Many companies conduct an overall company analysis as a part of their early compliances and audits. This helps them get a better picture of the company’s growth. You can often find growth percentages in the Annual reports and balance sheets of the company.

What Does a Company Analysis Include?

The contents of the company analysis depend on the objective for the comprehensive study. For instance, does the company want to understand the sales growth of the company? Or does a potential investor want an insight into the financial health? Let’s look at the common things analysed:

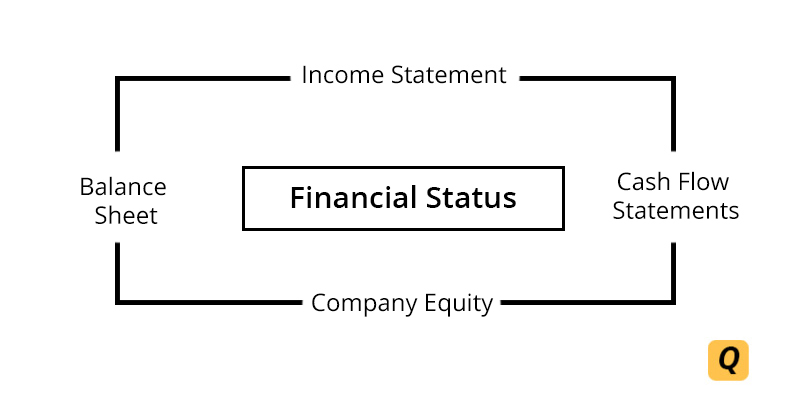

Financial Status

The financial analysis includes an examination of financial records for a period of three to five years. A financial analysis is important to understand the financial health of the company.

For instance, while the company might be generating profits, it does not necessarily mean positive cash flows. The cash flow analysis is required to understand the availability of cash, and if the profitable business can pay its bills.

Analysis of financial status typically includes:

- Examination of balance sheets and difference between gross and net profit

- Cash flow Analysis gives the status of ‘money in’ and ‘money out’

- Income statements highlight the sources of income and revenue generation activities

- Percentage of shareholders equity, share growth rates and evaluation of other securities

- Review of expenses in relation to company revenues

- Analysis of the company’s debt and investments

- Profitability and related growth from the previous accounting periods

Example

Cash flow analysis statement will show where the money from the net operating activities is going and highlights how much of that money is going out for the business.

Workflow Efficiencies

The factors such human resources employment and time of productively are analysed to determine the operating efficiency of an organisation.

Performance indicators vary from company to company, but the overall idea is to see if each of the operating departments meet their targets. This measures shortfalls and budgetary surpluses. In a business, shortfalls don’t always indicate slack in personnel, it could also mean that particular processes might need to be revamped.

- Availability of working capital and requirements of the same

- The ratio between productivity and human resource sick leaves

- The average hours of working and resulting productivity

- Budgetary spends of the departments and associated departmental costs

- Analysis of operating processes to highlight redundant processes and bottlenecks

- Manufacturing capabilities and productive hours

- Performance of marketing campaigns and lead generation initiatives

- Performance of employee programmes

- Understanding the workflow hierarchy and the effects of the same.

Example

The MoSCoW analysis is a popular tool to analyse the task priority in an operating cycle. It helps the business understand the roles and requirement of each component in the operating cycle. The ‘Must haves’, ‘Should haves’, ‘Won’t haves’ and ‘Could haves’ of each of these components are analysed to ascertain operating bottles necks and where processes can be improved.

External Factors

An analysis of the external factors looks at the various threats that affect the company from the outside.

- Political unrest and faltering of economic stability, economic trends

- Change in banking, FDI policies, industrial laws, financial laws, etc.

- Change in demographics

- Rising competition and alternative businesses

- Competition analysis

- Cost of raw materials and sourcing material

- Movement of capital and performance of securities.

Example

A SWOT analysis focusing on highlighting the core strengths, weaknesses to mitigate, prospective opportunities, and immediate threats of a company. It provides a perspective on where the company must be focusing its efforts, what it can avoid, and how to handle external risks.