Corporate Tax Rate Cut: Diwali Celebrations Come Early for India Inc.

September 22, 2019 by Archi Bhatia

Government slashes the corporate tax rate for domestic companies from 30% to 22% and for manufacturing company the tax rate is even lower.

The finance minister has introduced a big tax cut for corporates to boost the current sluggish economy and special lower tax rates for manufacturing companies that are one of the great contributors of GDP.

Dalal Street was lit after the announcement with an immediate rise in the Sensex; the Diwali sure came early for corporates that had to pay 35% corporate tax before which has been cut down to 25.2%.

The cuts have sent a powerful signal about the government intends to boost the economy and revive the sectors that have been most affected by the slowdown.

More Investments

Companies can opt to pay a tax of 22% on the income earned by forgoing any exemptions or incentives they have received. The change in the corporate tax encourages investors and is a positive way through which the manufacturing sector of the economy can be boosted.

The manufacturing companies formed from October 1st have to pay an effective tax of just 17%.

No More MAT

The manufacturing companies and domestic companies opting for the tax cut will be exempted from MAT. Minimum alternate tax is levied on all the companies/firms making a profit but have lower tax.

Gain the Capital Gains

A rejoice moment for foreign investors as the FM also removes the surcharge that is normally charged on the capital gains from the shares.

Income Tax Act

New provisions are to be inserted in the income tax act to bring in effect the following changes in the corporate taxes.

- The ordinance of change has already been passed and will amend corporate and finance act

- The effective tax rate for companies will be 25% and such companies don’t have to pay MAT.

- The companies will have an option of opting out of the concessional tax regime after the exemption period; till then they have to pay a corporate tax rate of pre-amendment.

- The companies that had introduced buyback before 5th July 2019 will be exempted from buyback tax introduced in the budget.

Corporate Tax Cuts: What they mean?

Corporate tax might have been introduced to give a boost to the economy which was on the downward slope but what impact will it have on the revenue the govt has to achieve.

Answering the above the Finance minister said that any low revenue funds will be partly funded by the government through transfers from RBI.

How we Fair Globally?

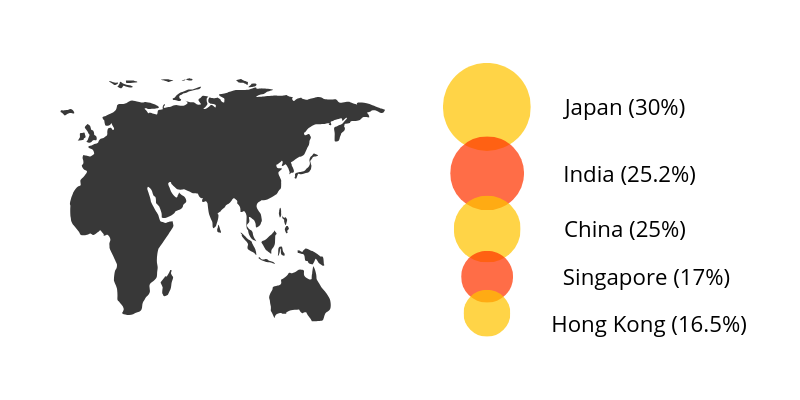

The lower rates in the corporate tax bring India closer to the other Asian counterparts that are providing the corporates lower tax rates to boost the investment and the economy equally.

The new tax rates are lower than a few other developed economies such as the USA and Japan which are at 27% and 30% respectively.

The Take-Away

- The effective corporate tax for manufacturing companies inclusive of cess and surcharge

- For other domestic companies, the effective corporate tax would round off to be 25%

- The tax cuts will be applicable from 1st April 2019

- The tax regime would be implemented with an amendment in the Income Tax Act.

- Adjustment in the advance tax paid will be done.

- The concessions are likely to bring in investment in the Indian companies and promote make in India initiative.

- An enhanced surcharge will also not be charged on the capital gains

Till date, the measure to reduce the corporate tax cut has been the boldest step and has brought in a bold change in the Sensex that showed all-time high. That is seen after 11 years in India.

The changes are made to bring int the change in the growth engine; what’s left to see is how is India going to fare?