DSC Registration on GST Portal

October 11, 2019 by Sheena Gupta

This article will assist you in understanding the step by step process of registering a digital signature certificate on the GST portal

In India, the digital era is prevailing and the country’s new tax regime i.e. Goods and Service Tax (GST) is also not left untouched. Digital signatures were already being used with income tax returns and ministry of Corporate Affairs and thereafter the government introduced the digital signatures and online filing for GST returns (GSTR) as well. This has proved to be helpful for those dealers who are having a business in different states and union territories of India as manual signing and filing will make the compliance process very complicated and time-consuming.

Digital signature certificate

Digital Signature Certificates are the digital equivalents of physical or paper certificates. For example drivers’ licences, passport, etc. are physical certificates which act as proof of identity for the specified purpose. Similarly, to establish the identity of a person, digital certificates can be presented electronically. Its main function is to digitally sign the documents. For example e-forms on various government sites for tax compliances etc.

Digital signatures are issued by licensed Certifying Authority. Certifying Authority means a person who has been granted a license to issue digital signature certificate u/s 24 of the Information Technology Act, 2000. The list and the contact information of the licensed Certifying Authorities are available on the MCA portal. To name a few:- National Informatics Centre, Sify Communication Ltd., E-MUDHRA, NSDL, etc.

DCS in GST

DSC has replaced physical signatures and it is compulsory for companies, limited liability partnerships, PSUs and optional for other taxpayers to sign and file returns on GST portal. For this, the concerned person has to get a digital certificate from the Certifying Authority, which can be either Class 2 or a Class 3 signature (which comes with a validity of 1 year, 2 years and 3 years). Apart from GST, Class 2 Digital Signature may be used for ROC, EPFO, MCA21, Income Tax filings and many more. DSC comes in a USB token with password protection to ensure security.

Steps to register DSC with GST portal

Install the emSigner utility, before registering your DSC at the Common GST portal. Access the Register DSC page for downloading the utility. Registration of DSC is based on the PAN and GST portal accepts only the Class 2 and Class 3 DSCs.

Perform the following steps and register your DSC with the GST portal :

1. Access the GST home page. Click here.

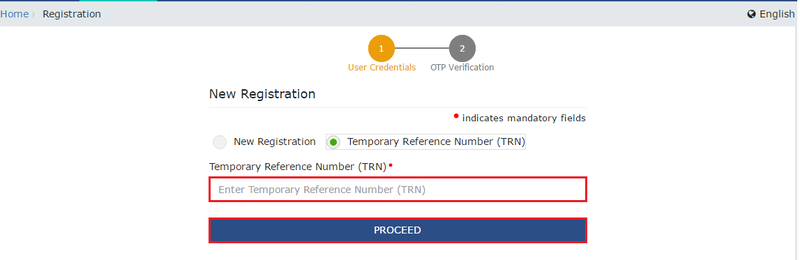

In the case of New Registration:

a. Click the link ‘Register Now’.

b. Select the option ‘Temporary Reference Number (TRN).

c. Enter the TRN received in the ‘Temporary Reference Number (TRN) field.

d. Next, click the PROCEED button.

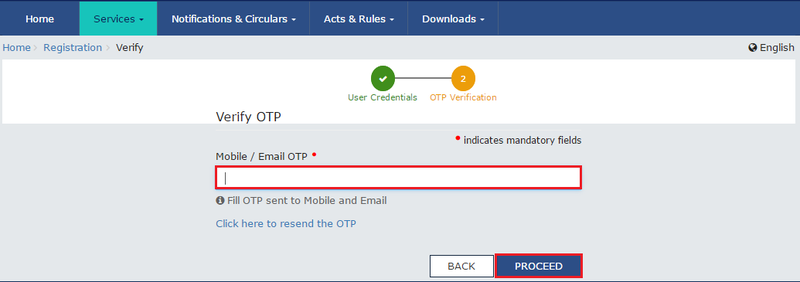

e. An OTP will be received on your mobile and e-mail address, enter it in the Mobile/Email OTP field.

Note:

- OTP is valid for 10 minutes only.

- Same OTP is sent on the mobile number and e-mail address.

- If it an invalid OTP, click the link ‘Click here to resend the OTP’. The OTP will be sent again on the mobile number and email ID. Enter the newly received OTP.

f. Click the PROCEED button.

g. Select the following: - Services ⇒ User Services ⇒ Register/Update DSC.

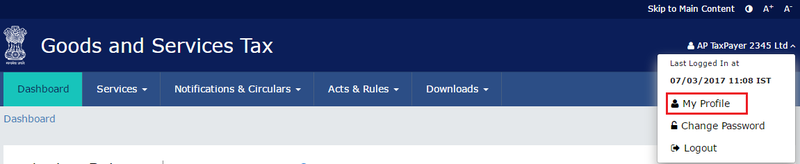

In case of Existing Registration:

a. With valid credentials, log in to the GST portal.

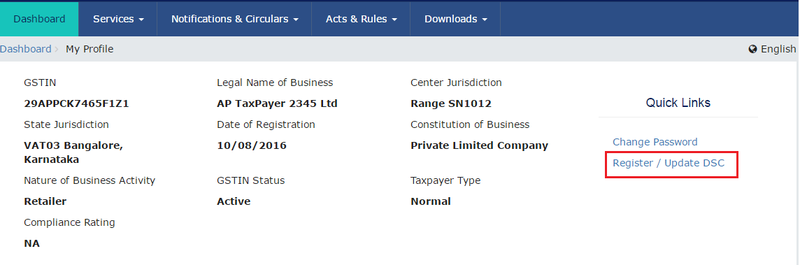

b. Go to the link ‘My Profile’.

2. Select the link ‘Register /Update DSC’.

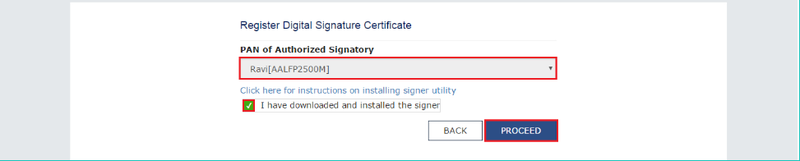

3. Now, the’ Register Digital Signature’ page will be displayed on your screen.

- Select the PAN of the Authorised Signatory you wish to register under the ‘PAN of Authorised Signatory’ drop-down list.

- Click PROCEED button.

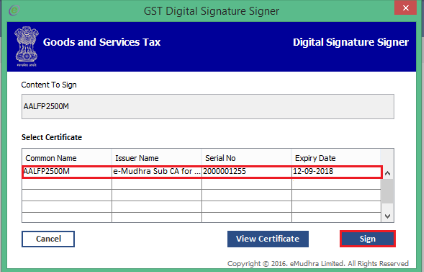

4. Make sure you have successfully downloaded and installed the emSigner utility in your system, thereafter the following screen will be displayed. Click the ‘Sign’ button after choosing the relevant certificate.

Finally, a status message will be displayed confirming the successful registration of your DSC on GST portal.