Cancellation of GST registration

October 11, 2019 by Sheena Gupta

From 1st July 2017, Goods and Service Tax was made effective in India, since then the government is trying to make the compliance easier by allowing online filings of forms, applications and returns.

The article discusses various provisions affecting cancellation of GST registration, persons who can apply for cancellation, probable reasons for cancellation and the procedure thereon.

Following persons can apply for GST Registration Cancellation-

- Registered Taxpayer

- Tax Officer

- Legal Heirs of deceased Taxpayer

Reasons for filing for GST registration cancellation application can be as follows:-

- Change in PAN due to change in the constitution of business.

- No more liable to pay tax.

- Discontinuation/closure of the business.

- Others

- Transfer of business due to combinations, sale, lease or otherwise.

Perform the following steps to file for cancellation of GST registration:

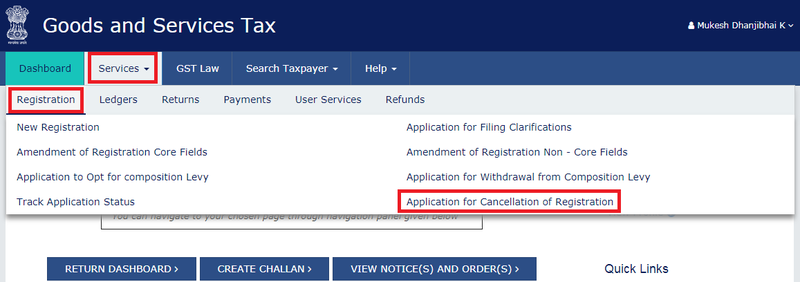

Step 1 - Login to the GST portal. Click here.

- Enter the user-ID and password to login to the GST portal.

-

Select the Services ⇒ Registration ⇒ Application for Cancellation of Registration option.

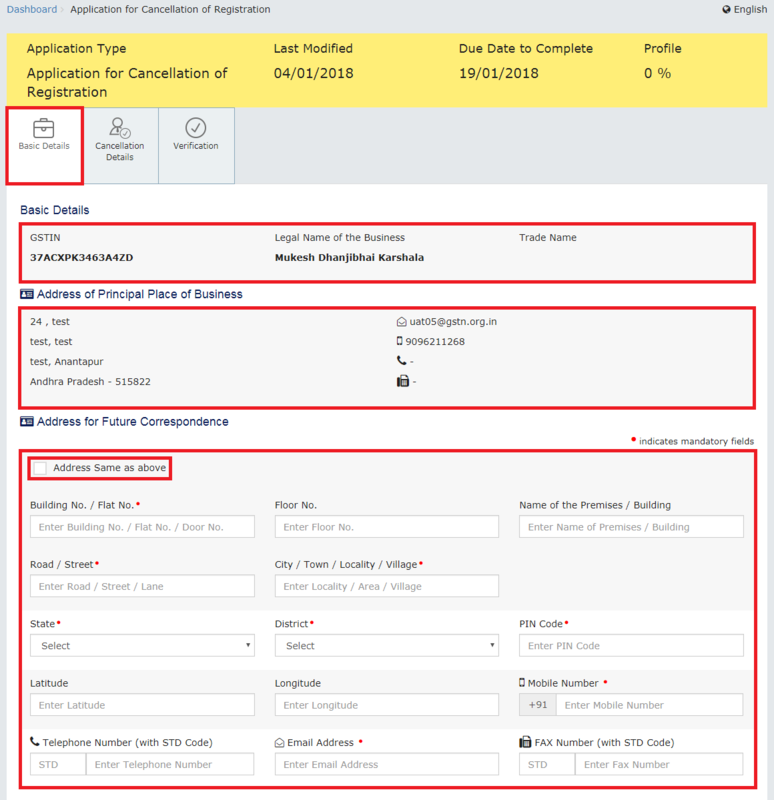

Step 2 – ‘Application for Cancellation of Registration’ form containing 3 tabs will appear on the screen, make sure that the ‘Basic Details’ tab is selected already. This section consists of pre-filled basic information and Address of Principal Place of Business.

- You can manually enter your ‘Address for Future Correspondence’, or you can select the ‘Address same as above’ option.

- Click the ‘SAVE & Continue’ button.

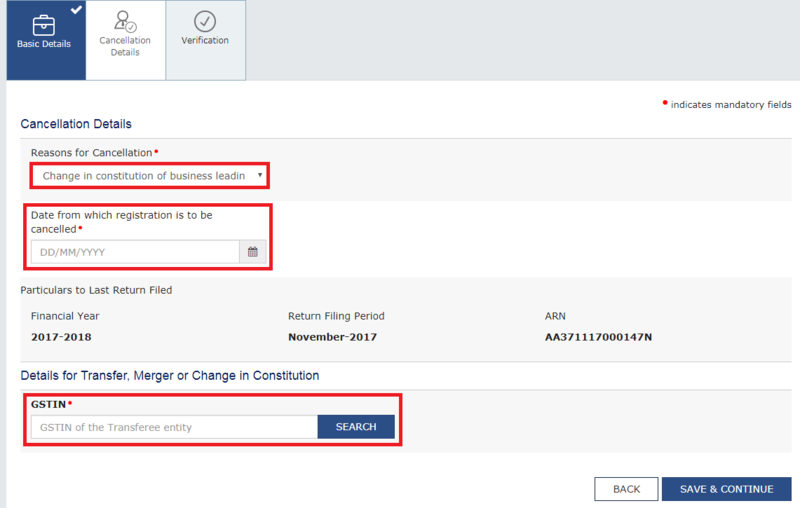

Step 3 – Come over to the ‘Reasons for Cancellation’ drop-down list to choose the suitable reason for the same.

Reasons available to choose from are as follows:-

- Change in PAN due to change in the constitution of business

- No more liable to pay tax

- Discontinuation/closure of business

- Others

- Transfer of business due to combinations, sale, lease or otherwise

⇒Enter the date from which the registration is to be canceled as well as the reason specific details for the cancellation.

⇒Click the ‘SAVE & CONTINUE’ button.

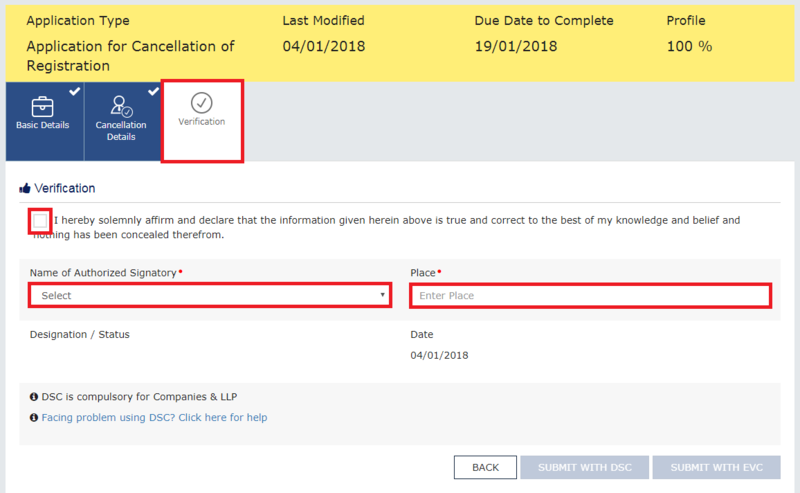

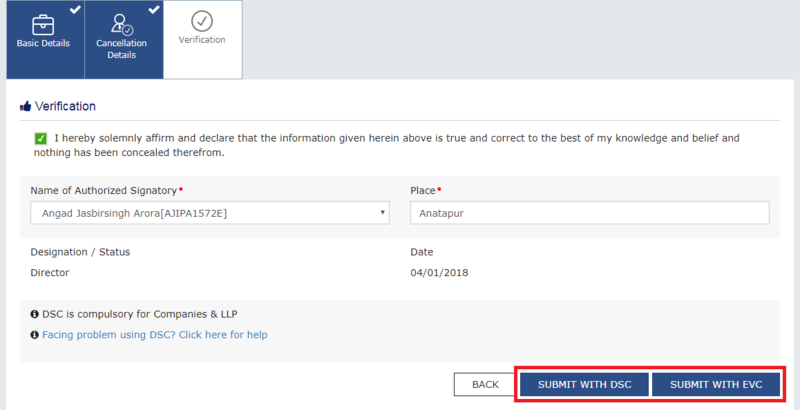

Step 4 – Verification statement box is to be selected as an undertaking that the information provided in this form is true and correct and none of the information is concealed.

- From the ‘Name of the Authorised Signatory’ dropbox, select the name of the authorized signatory.

- Thereafter, enter the place of making the concerned declaration.

Step 5 - Use your DSC or EVC option to sign this form. Enter the OTP on the OTP verification page.

Notes:-

- The system will generate the ARN and display the acknowledgment on the successful filing of the registration cancellation application.

- You will also receive the GST portal sent confirmation message on your registered mobile number and e-mail ID.

- After this, your application will be reviewed by the concerned Tax Official and he will make the decision accordingly.

- You can also tack the Application Status on the same website.