PAN Card Cancellation

November 22, 2021 by Deeparzoo Bhogal

Permanent Account Number (PAN) is issued by the Indian Income Tax Department. It consists of a 10-digit alphanumeric code.

According to Section 139A of the Income Tax Act, 1961, an individual can hold only one PAN at a time. If an individual has more than one PAN at a time, they can be penalized as per Section 272B of the Income Tax Act, 1961.

How to Cancel an e-PAN Card?

There are two modes to cancel your PAN card:

Online Mode

- Applicants need to visit the NSDL official website.

- Amongst the online PAN services provided, select the option to apply for online PAN.

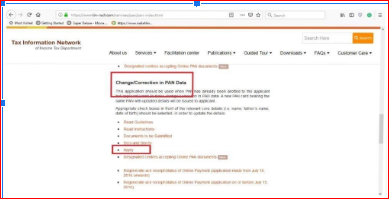

- Now select the option change/correction and apply.

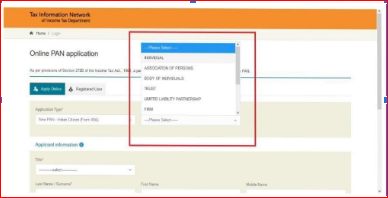

- The application form will appear on the screen, on which-

- Select the application type, i.e., changes or corrections in existing PAN data/reprint of PAN card (No changes in existing PAN card), and

- Select the category type.

- After filling in the information of the applicant, agree to the terms and conditions and enter the captcha in order to submit the form.

- On the next page, the required documents have to be uploaded through the e-sign of the applicant.

- PAN has to be entered that is being surrendered/canceled along with payment for the same.

- Upon successful payment, a downloadable acknowledgment will be received that needs to be printed.

- Applicant must hold the copy of the acknowledgment received which acts as proof that the applicant has successfully applied for PAN Cancellation.

- A printed copy of the acknowledgment along with required documents, two passport size photographs in an envelope can also be sent to the NSDL office.

Offline Mode

- Applicants need to visit the NSDL office/centre.

- Form 49A needs to be filled out along with required documents, two passport-size photographs and the same is to be submitted.

- There is also an alternate offline method where the applicant can also write an application to the Assessing Officer of the concerned jurisdiction.

- Such an application must contain the details mentioned below-

- Name of the applicant,

- Current address of the applicant,

- Details of the additional PAN that has to be surrendered/cancelled.

- Details of the PAN that the applicant wants to continue to use.

- Applicant must hold a copy of the acknowledgment received which acts as proof that the applicant has successfully applied for PAN Cancellation.

How to check the status of PAN Cancellation?

The status of the PAN cancellation can also be checked. The steps that need to be followed are:

- Visit the official Income Tax India site for filings.

- Click on Know Your TAN/AO on the homepage.

- Now select the category type and state.

- Mention the name and mobile number of the applicant.

- After submitting the same, the status of the PAN Cancellation request will appear.