Process and Criteria for GST Registration in India

January 17, 2019 by Archi Bhatia

GST registration in India is mandatory for businesses with an annual turnover of Rs. 20 lakh per annum and in certain North East state 10 lakh per annum. The Complete GST process involves submission of the soft copy of the documents along with the required fee.

The entire GST registration process takes up to 2-3 working days for you to receive GSTIN. In the initial stage, the authorities may issue resubmission that might increase the number of days for registration.

Who Should obtain GST Registration?

Individuals who were existing taxpayer have to register themselves along with all businesses having turnover more than 20 lakh (10 lakh for NE). The applicants that have business in more than one state need to register themselves irrespective of the fact that the applicant has a turnover less than 20 lakh.

Registration Process

Step- 1 Declaration of the following Information

You or the company registering GST online need to submit the following information with application form GST REG-04 before proceeding with the application.

- PAN: GST authorities will verify the PAN card provided.

- Mobile number and E-mail Id: An OTP will be sent on the registered number and the email -id for verification.

After the following process is completed the GST officials issue an Application Reference number(ARN) which is issued on mobile number and email-id.

Step- 2 Review of the Application

The applicant is provided with an acknowledgement receipt with which the applicant needs to complete the second part of the registration process. The second form the applicant requires to provide complete information about the principal place of business.

If the authorities find that the documents submitted are not satisfactory, then the applicant will receive resubmission which will have to have complied within 2 days.

STEP- 3 Grant of GSTIN

The applicant will be granted GSTIN once the application is approved and all the document submitted are verified.

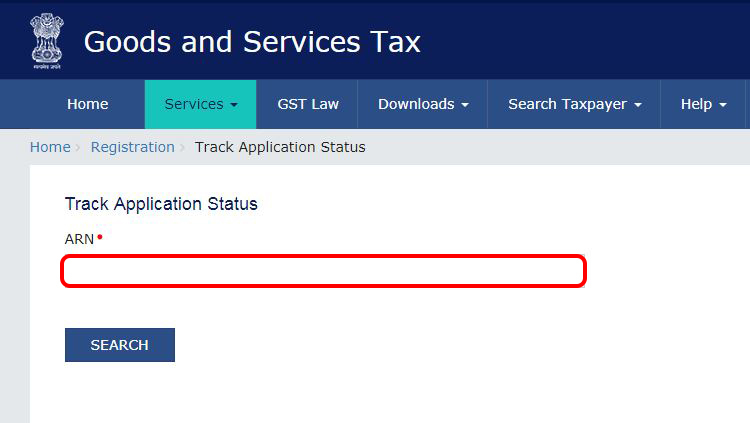

GST Application Status

Once the application for GST is submitted with the government the applicant can check the status of his application through Application Reference Number(ARN) online on GST portal.

Penalties for Not Registering GST

GST is mandatory and hence anyone not complying with the said norm will have to pay a heavy penalty and under certain cases will be liable for imprisonment. Offenders evading taxes are liable for 100% penalty on the tax amount evaded.