Understanding the Concept of a Holding Company

October 04, 2018 by Akshara Bala

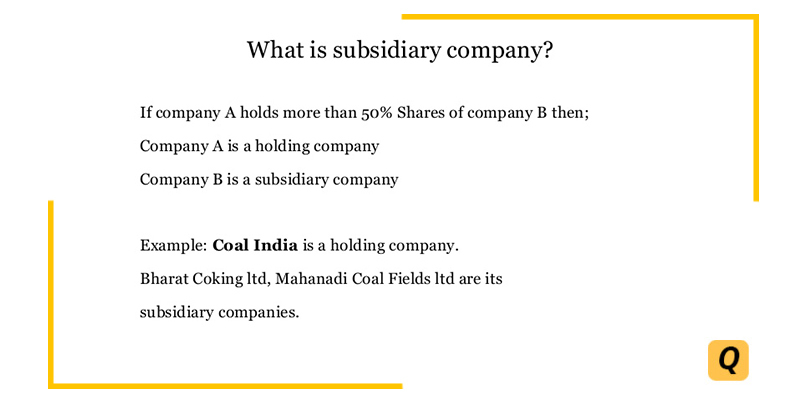

A Holding Company is a Parent Company that holds a majority interest in several companies. For instance, if the shares of a limited or a private company are held by another company, then such a company is called a ‘Holding Company’. The relationship created is that of a subsidiary and holding company. In most cases, the subsidiary companies operate independently, except in the case of the ownership.

Today we several companies are formed as large conglomerate companies, with multiple subsidiaries under them. Several popular conglomerates include Volkswagen, Walt Disney, etc.

What is a Holding Company?

Holding companies are recognized under the Companies Act, 2013, as the controlling company that exerts a certain amount of control over subsidiary companies.

Control Factor

The ‘control’ factor is an important factor in determining the status of a holding company and the relationship with its subsidiaries. In most case, the control of the holding company is exerted through shares, where the controlling company holds at least 51% of the total holdings. A company becomes its associate when the holdings over 20% (but not beyond 51%).

Wholly-Owned Subsidiary

When the holding company holds 100% of the common stock of the subsidiary company, then the subsidiary is called a wholly-owned subsidiary.

Control Other Than Shares

The holding company can also exert additional control by virtue of the composition of the board of directors and the management. So, the holding company will have majority powers to appoint and remove the majority of the directors of the company.

Control Through Other Subsidiaries

The holding company can either hold the shares of the subsidiary directly or through one or more of its other subsidiaries. Also, a subsidiary company that’s held by another subsidiary company will automatically become the subsidiary of the parent company. For instance, if ABC is the holding company of MNO, and XYZ is the subsidiary of MNO, the XYZ automatically becomes the subsidiary of ABC.

Purpose of Setting up a Holding Company

- Dividing different business ventures: Multiple business lines of a company differently, and these can be divided in a manner to have an independent legal identity. Therefore the subsidiary can independently function like any other normal company, hold assets and trade under its name.

- Dividing Tax Burden: With multiple subsidiaries, the tax liability of the parent company is divided and distributed; this reduces the burden on a single company.

- Regulatory Mandates: As Indian keeps promoting FDI policies and ease of doing business, we see a lot of foreign companies coming in. According to certain policy mandates, the businesses would have to operate through separate companies, rather than opening branch offices.

- Business Mergers and Acquisitions: The result of merger and acquisition ventures result in a new subsidiary company being formed.

Structure of a Holding Company

Holding companies structures are most appropriate large companies which have diverse business operations, investment, and assets in multiple industries. The main purpose of the holding company is to hold the assets and valuable holdings and not actually engage in any business operations. Here is a breakdown of the various structure of the holding company.

Assets

The holding company can group its subsidiaries into various sub-groups such as Chemical products, consumer products, Energy, engineering, etc. However, each of the subsidiaries operates with separate employees, separate office spaces and facilities. Only the control and management remains of these assets with the holding company.

The holding company on its part maintains the capital of all these subsidiaries since it holds the majority ownership. So, the holding company’s board is hired to make decisions about the subsidiary company. Further, the holding company can lend its support to its subsidiaries, in the form of low rate bonds, lending money and lowering capital costs.

Internal Operations

The structure of a holding company can be classified as follows. The Companies Act does not separately recognize these structures. These structures are more for understanding the working of holding companies. The internal structure of an organization defines the roles of the employees as well as the various departments that function independently, yet cohesively.

- Simple: The structure is where there is a small board of directors and a limited number of employees and operations. There are not many departments because the scales of operations are not so high. This could be because the number of subsidiaries that the company holds might not be too many.

- Functional: These are larger companies such as Tata Group of Companies. Here, even the holding company is divided into multiple divisions such as finance, Audit, Human resources etc. These divisions have been made to bring ease to the management of the group companies, mainly because the numbers of subsidiaries are extensive.

-

Divisional: These are companies, where the holding company is located in one country and the subsidiary offices are located in several parts of the in the world, having their own independent operations. For instance, Microsoft India (R&D) Pvt Ltd is the overseas subsidiary of Microsoft Corporation.

Income

Based on the structure and the workings of a holding company, it can generate income in various ways. The bank accounts of the holding company and its subsidiary companies are separate, and they have to also independently adhere to regulatory and statutory requirements.

- Holding major business assets and licensing or leasing them to the subsidiary companies

- By lending money to subsidiary companies and gaining interest in return.

- Making viable business investments

- Have their own products and services that generate revenue. Example: Facebook.

Business Operations

Most holding companies don’t have their own operations and conduct their operations through their operating companies. They don’t directly engage in revenue-generating ventures.

This separation is following by companies like Tata and Reliance so that the Corporate Veil is not affected, and the limited liability of the company is maintained.

However, in most recent times we don’t always see this differentiation, as mentioned above Facebook is a holding company that has its own operations.

Advantages of Holding Company Structure

The holding- subsidiary structure can be beneficial in a number of ways. The main reason is to retain the control. Here are a few more beneficial reasons to set up a holding company:

- Management and control: Usually large group companies are easy to control and manage under the holding-subsidiary structure. For Example, the holding company Tata Group of Companies have different subsidiary companies like Tata Chemicals, Tata Steel, Fastrack, Tanishq, Tetley, Tata Salt, Tata Sky, Tata Power, Voltas and much more. Through the holding and subsidiary model, the parent company will be able to control and manage all the other companies under it.

- Promotes Expansion: The structure helps the parent company expand and open more ventures without hindering the existing structure. For instance, Tata entered into a joint venture with Starbucks and formed the subsidiary company called Tata Starbucks and also acquired the Tetley Tea company.

- Ease in Financial Management: For a holding company, it becomes easy to measure which of its venture are doing well based on the financial performance of the company. This differentiation helps make key financial decisions and also diversify loses. Additionally, the financial separation helps mitigate high tax brackets. Additionally, it’s much more convenient to raise

- Cross-Border expansion: Most foreign offices MNCs are set up based on the holding and subsidiary structure. For instance, Facebook, which is a public company in the U.S. is set up as a private limited company in India, wholly owned by the U.S. based parent company. This helps a business have multiple holdings around the world that independently function as per the relevant laws of the land, yet can be controlled by the parent company.